how to calculate compound interest

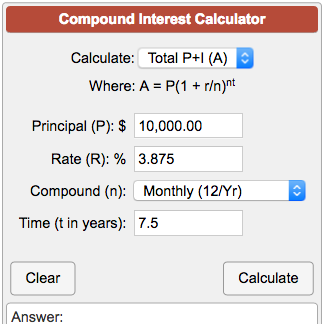

Enter an initial balance figure. A The whole amount youll receive.

Compound Interest Formula With Examples

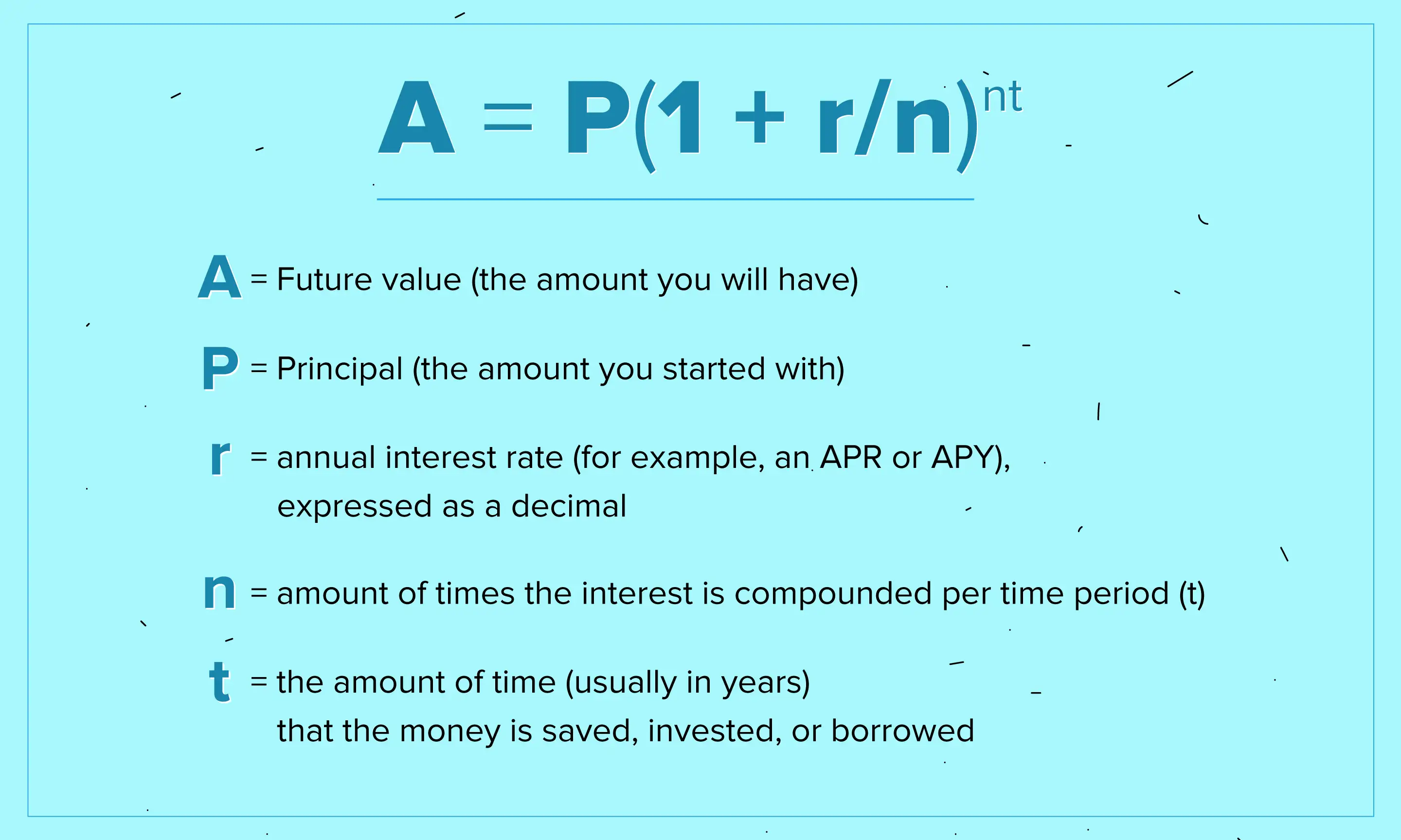

In the formula A represents the final amount in the account after t years compounded n times at interest rate r with starting amount p.

. Heres how to use it. Assume you put 100 into a bank. Length of time in years that you plan to save.

Following is the formula for calculating compound interest. N Number of Periods. How to Calculate Compound Interest in Google Sheets 3 Examples We can use the following compound interest formula to find the ending value of some investment after a certain amount of time.

With compound interest the amount you are calculating interest on changes every year. How To Calculate Compound Interest. How to calculate compound interest.

Thought to have originated in 17th-century Italy compound interest can be thought of as interest on interest and will make a sum grow at a faster rate than simple interest which is. A P 1 rnnt The compound interest formula solves for the future value of your investment A. Compound Interest Formulas Calculation Formula Calculate accrued amount Principal Interest A P 1 rn nt.

The interest rate and number. You need the beginning value interest rate and number of periods in years. The basic formula for Compound Interest is.

You already know the answer. Below you can find information on how the compound interest calculator works what user input it accepts and. A P 1 rn nt.

N the annual number of compounding periods for. Amount that you invest initially. To calculate compound interest use the formula below.

Finds the Future Value where. For the formula for compound interest just algebraically rearrange the formula for CAGR. What it means to start saving now vs saving later how to calculate compound interest.

Our compound interest calculator gives you a future balance and a projected monthly and yearly breakdown for the time period. Daily Weekly Monthly Quarterly Yearly. Compound interest is when a bank pays interest on both the principal the original amount of moneyand the interest an account has already earned.

Compound interest or compounding interest is the interest on a loan or deposit calculated based on both the initial principal and the accumulated interest from previous periods. The compound interest formula reduces to 1001008115 1001085. Interest can be compounded on.

Length of Time in Years. The compound interest formula is. Compound Interest Formula Below is the compound interest formula on how to calculate compound interest.

How the power of compounding increases your savings interest. Assume you put 10000. Compound interest is the interest calculated on the principal and the interest accumulated over the previous period.

Amount that you plan to add to the principal every month or a negative number for the amount that you plan to withdraw every month. A P 1 rn nt Where. P The principle is your initial deposit.

What is the compound interest formula. In the calculation the interest rate will have to be input as decimal. In this example this would be 345100 00345.

Compound interest or interest on interest is calculated with the compound interest formula. To calculate your future value multiply your initial balance by one plus the annual interest rate raised to the power of the number of compound periods. Select your compounding interval daily.

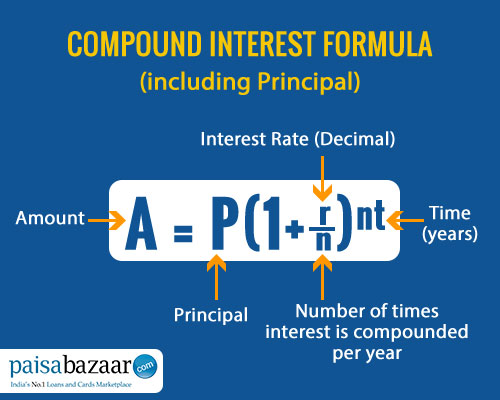

Amount that you plan to invest periodically. The formula for compound interest is A P 1 rnnt where P is the principal balance r is the interest rate n is the number of times interest is compounded per time period and t is the number of time periods. How do you calculate compound interest.

This compound interest calculator helps you easily identify. FV Future Value PV Present Value r Interest Rate as a decimal value and. The formula for calculating compound interest is A P 1 rn nt For this formula P is the principal amount r is the rate of interest per annum n denotes the number of times in a year the interest gets compounded and t denotes the number of years.

Convert it by dividing the interest rate by 100. Enter a number of years or months or a combination of both for the calculation. Compound interest is calculated by multiplying the initial principal amount P by one plus the annual interest rate R raised to the number of compound periods nt minus one.

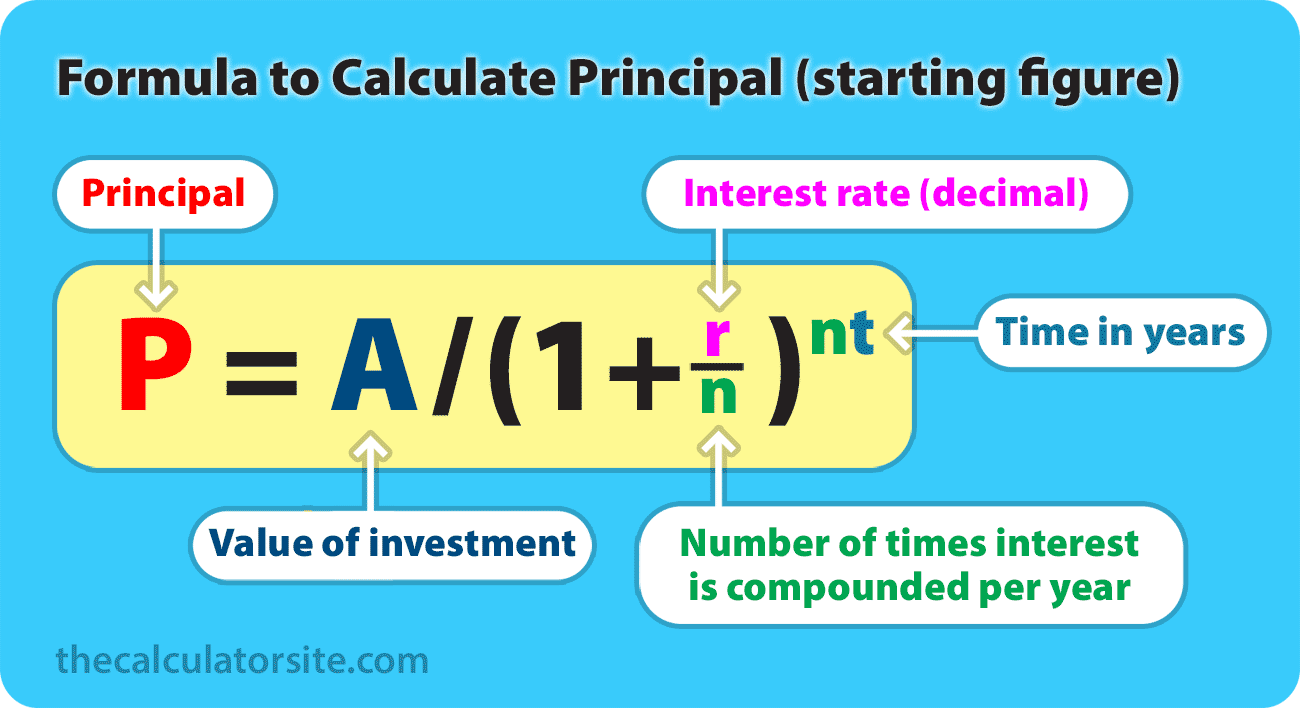

And by rearranging that formula see Compound Interest Formula Derivation we can find any value when we know the other three. A is the future value of investmentloan including interest earned P is the the principal investment or loan amount r. R the yearly interest rate in decimal form.

PV FV1r n. FV PV 1r n. How much will your investment be worth after 5 years at an annual interest rate of 8.

The tables below show the compound interest formula rewritten so the unknown variable is isolated on the left side of the equation. A P1 rn nt. However you can easily create a compound interest calculator to compare different rates and different durations.

The interest is calculated for the first year and is then added on. Enter a percentage interest rate - either yearly monthly weekly or daily. Compound interest is calculated by multiplying the initial principal amount by one plus the annual interest rate raised to the number of compound periods minus one.

The basic compound interest formula A P 1 rn nt can be used to find any of the other variables. How much money youll have if you save regularly. To use this calculation enter the following variables.

How to calculate compound interest You can calculate compound interest growth on your savings or investments using the compound interest formula.

4 Ways To Calculate Compound Interest Payments Wikihow

Compound Interest Formula With Examples

What Is Compound Interest Money Com

26 Compound Interest Formula Exponential Growth Of Money Part 1 Calculate Compound Interest Youtube

Compounding Interest Formulas Calculations Examples Video Lesson Transcript Study Com

Compound Interest Formula And Calculator Paisabazaar Com

How To Calculate Simple And Compound Interest Double Entry Bookkeeping

0 Response to "how to calculate compound interest"

Post a Comment